Currently, there is a great trend that encourages wearing a healthy life style. Society has become aware of the importance of taking care of Physical Health. Today we make great efforts to eat correctly and maintain healthy habits. The importance of taking care of emotional well-being has also been made visible, in a social and open way, and, closely linked to this, there appears financial health.

The financial health consists of a correct money management; people’s main concern after physical health and the cause of many well-being problems, such as stress and anxiety.

Good health in this area takes into account the control of day-to-day spending, the balance between income and expensessavings to generate a cushion against unforeseen events, debt management so that it is manageable and, finally, future planning, for retirement.

Technology as an ally of financial health

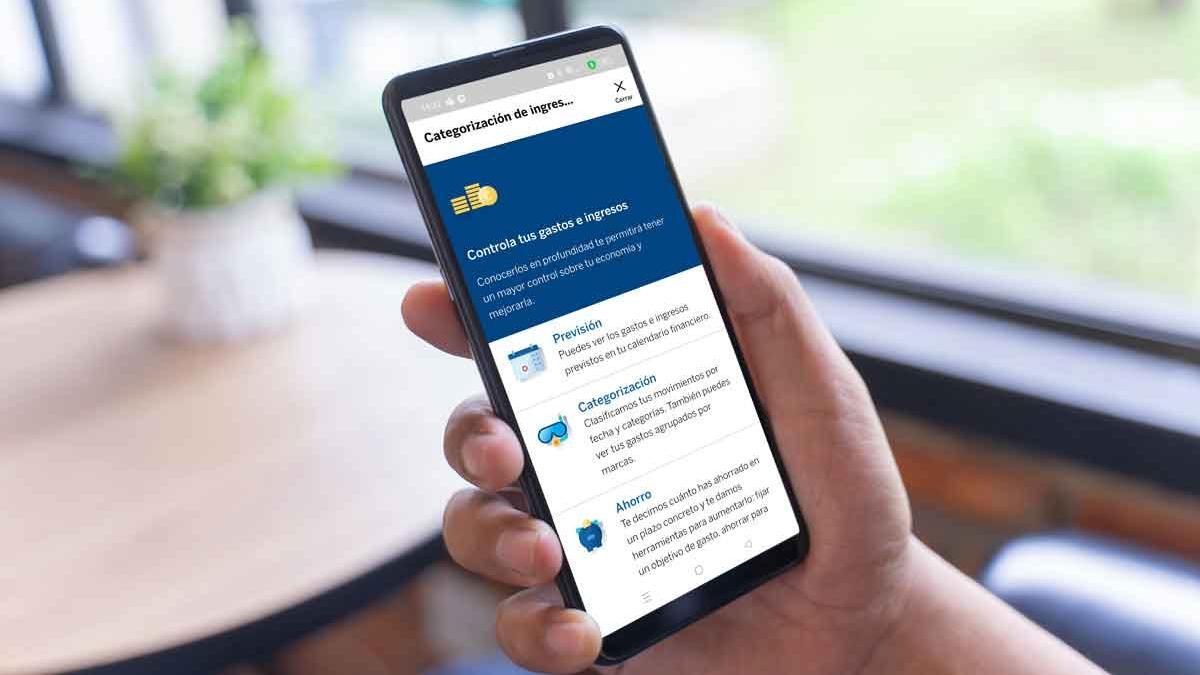

Help people achieve good financial health is a priority objective for BBVA. The entity has developed digital solutions that make it easier for clients to make financial decisions. Thus, through the bank’s application, it is possible to keep track of the day-to-day, being able to establish notifications when there is a higher bill than usual or when you do not receive an income that you usually receive every month.

In addition, clients have in the ‘app’ a space saving which establishes how much is necessary to save to have an adequate cushion against possible unforeseen events, as well as a debt space that alerts if this is greater than 35% of income. Likewise, it is possible to make monthly comparisons of expenses and categorize them automatically, have information about those that are fixed, clearly see the income obtained and know the forecast for the following month.

These tools are just some examples that are added to those that BBVA also offers its website for clients and non-clients, such as financial cushion calculator, that allows you to know the ideal amount to save for unforeseen events or the monthly budget and savings calculator based on the 50/30/20 rule which promotes allocating 50% of income to fixed expenses, 30% to more sporadic expenses and allocating 20% of income to savings, whenever possible. In addition, there are other features, such as simulator to save on heatingwhich allows you to know the energy consumption day by day in order to reduce the electricity bill.

Lastly, it is important to long term planning. For it, it is very useful the ‘Learn to invest’ functionality, through which the client can access advice for making investments, see how inflation affects their savings or get in touch with investment funds in an educational way.

Financial education for better financial management

For BBVA, Financial health and financial education must be available to all of society. For this reason, the entity assumed the commitment to train, globally, two million people between 2021 and 2025. The entity considers that for In order to have good financial health, you have to acquire good financial management habits from a young age.because all that knowledge accompanies people throughout much of their lives, helping them make better decisions at key moments.

And, precisely, with young people, it is important to work on guidelines to manage their payments well, or their birthday money, teaching them to spend appropriately and set aside a portion for savings from an early age. Technology provides a unique opportunity to achieve this, since young people are digital natives and the mobile phone accompanies them everywhere. For this reason. BBVA was the first bank in Spain to adapt its ‘app’ for minors under parental control and supervision. Some of the functionalities enabled for them are balance checking, mobile recharge, cash withdrawal and operation with Bizum. And recently new features have been added to encourage savings, such as the possibility of creating accounts where they can send the entire available balance at the end of the month.

Advice for companies and self-employed

The financial health It has great importance for society in general; but also for SMEs and the self-employed, since, in their case, in addition to the domestic economy they have to manage their business. In this sense, BBVA has developed solutions based on technologies such as ‘big data’ or artificial intelligenceto facilitate business management and financial decision making.

An example is the financial health report that the bank makes available to SMEs through its managers. Thanks to this tool, SMEs will have more personalized support that will allow, among other things, to reduce the deadlines in resolving the financing study, obtain a comparison with similar companies or control their liquidity in real time. The key is to offer relevant information to help in making key decisions, and that the SME or the self-employed You can focus on growing your business.

Make the best decisions and acquire habits to take care of your financial health It is key for people to achieve their goals and be prepared for unforeseen events, avoiding emotional problems such as stress and anxiety and, thus, preventing poor money management from interfering with achieving a desired and happy life.