Vincent Nichols explains why growing demand for healthcare continues to put pressure on the sector to provide greater levels of safety and resilience. Commentary sponsored by BNP Paribas Asset Management.

GRANDSTAND of Vincent Nichols, Investment specialist at BNP Paribas Disruptive Technology. Comment sponsored by BNP Paribas Asset Management.

Innovation and technological adoption will be crucial aspects when it comes to ensuring the health of the world. With the development of new treatments and technologies, the healthcare landscape will undergo profound changes, creating new markets and disrupting existing ones. For investors, this dynamic will inevitably lead to new and innovative investment opportunities.

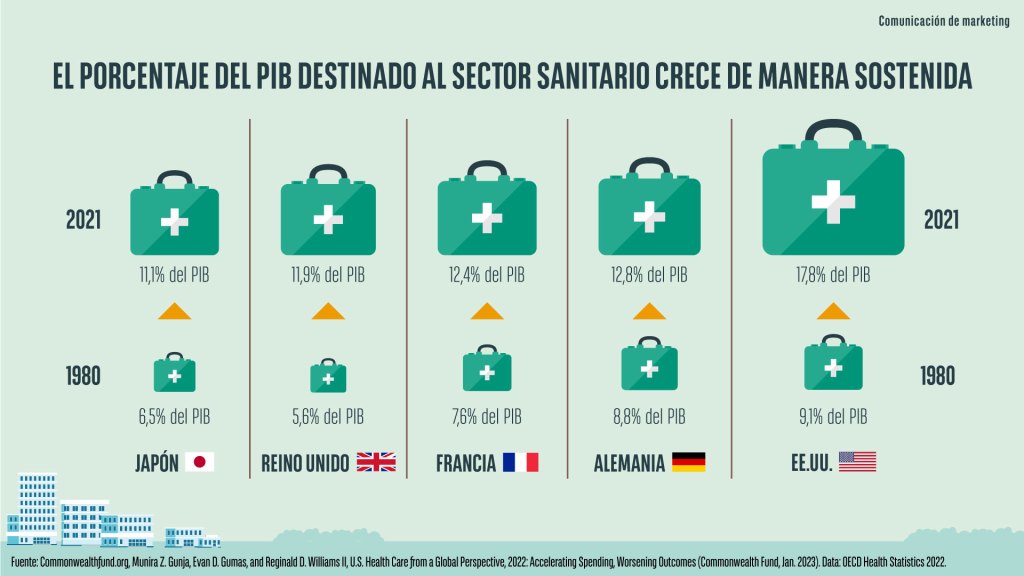

Health spending growth exceeds GDP growth

Global healthcare spending as a percentage of GDP has long been increasing and will continue to do so going forward: healthcare spending is anticipated to grow continuously between 2024 and 2029 to 6.26% of global GDP (from 6.08% current) and at a faster rate than GDP(1).

The growth in healthcare demand can be attributed to several main drivers:

- Demographic trends: The aging of the world population translates into an increasing use of health services.

- Lifestyle: Increasing rates of obesity increase the incidence of associated diseases, with subsequent medical repercussions.

- Innovation– Treatment development is accelerating, with new therapies for previously untreatable conditions, and technological solutions propelling healthcare to the next level.

- Wealth effect: Given the close correlation between GDP per capita and health spending, growing wealth increases the demand for health care, especially in the emerging universe.

Rising demand puts pressure on budgets, while healthcare innovation disrupts existing markets. From an investment perspective there will be winners and losers, so a fundamental bottom-up approach will be crucial to obtain solid long-term returns.

Biopharmaceutical advances

The biopharmaceutical landscape is undergoing a transformation due to innovations in DNA sequencing, novel drug delivery technologies and artificial intelligence. The cost of genetic sequencing has dropped from about $100 million per genome more than 20 years ago less than 1000 dollars Today(2). This reduction in cost makes sequencing studies viable at the population level to identify mutations capable of causing diseases. Analysis of genomic data is revealing new therapeutic targets for previously untreatable or inadequately addressed ailments.

Advances in drug delivery have led to the possibility of inserting or editing genes, affecting gene expression at the RNA (ribonucleic acid) level, or manipulate the body’s immune system to fight cancers or autoimmune disorders. This coincides with the development of precision medicine using biomarkers, and the advance in liquid biopsies is changing the way cancer is detected and treated. Artificial intelligence is also used in healthcare analysis and development to advance and optimize chemical design, improve manufacturing development, accelerate clinical testing, and enhance diagnostics.

Technology and healthcare

Technology is also disrupting healthcare delivery in multiple areas. Engineering advances have enabled the miniaturisation and automation of medical procedures, fostering the development of minimally invasive surgical techniques that improve outcomes and enable patients to be discharged more quickly. In the treatment of diabetes, miniaturized insulin pumps are being combined with continuous glucose monitors and AI-based control algorithms. This closed-loop system (also known as an ‘artificial pancreas’) allows the patient to manage their disease more effectively and with minimal intervention.

In the operating room, advances in robotic surgery technology are being integrated into a software ecosystem that captures all pre-, current and post-operative information to distill best practices and communicate this learning to the user base. These data have reduced variability between surgeons and are improving outcomes for the patient with less trauma. The lower cost of 3D printers and new applications for this technology also have potential to benefit the healthcare industry. Future advances could include the use of these devices to produce patient-specific organs for transplant, thereby reducing the risk of rejection.

A challenge for investors

This rapid evolution of the sector, fueled by complex innovation, can be difficult for general investors. Some of these advances could come at the expense of existing treatments and technologies, forcing companies to decide how to allocate their budgets. In the long term, investing in this sector requires a thorough and in-depth process of fundamental analysis to find the right opportunities.

Secular trends and innovation should support long-term outperformance of the healthcare sector versus the broader equity market, but this progress is unlikely to be linear. 2023 was a particularly tough year for many health actions, which faced numerous obstacles. Rising interest rate environment hit small- and mid-cap biotech and medtech companies, with life sciences and contract research groups suffering from post-pandemic inventory drawdowns and cut R&D budgets D, and managed care stocks were hit by declining Medicaid enrollment in the U.S. Big biopharmaceuticals, meanwhile, came under pressure from looming patent expirations and concerns over ensuing price negotiations. .

A rare ray of light in such an environment was the enthusiasm around new anti-obesity medications, whose manufacturers saw their prices soar. However, this development weighed on the medical technology market as a whole, with fears that these highly effective drugs will affect other markets and companies in this universe, and the obesity trend is not going to disappear just like that. Many of these obstacles were short-term, and looking ahead, the outlook for the sector looks much sunnier.: Valuations are more attractive and opportunities abound. In light of the aforementioned complexities, however, healthcare remains a difficult sector to navigate.

Address healthcare from a thematic approach

The combined forces of strong healthcare demand and abundant healthcare innovation should present many opportunities across multiple interconnected markets and sectors. Nevertheless, find the right opportunities during this period of transformation It will require deep fundamental analysis, an open mind, and the ability to examine challenges and opportunities from multiple perspectives.

He BNP Paribas Health Care Innovators combines a thematic approach with a sustainability framework that allows our experienced equity team select the most attractive stocks from a thematic and sustainability perspectivewith the aim of providing superior returns in the long term.

Discover how combining perspectives can create opportunities.

Sources and notes:

1 https://www.statista.com/forecasts/1141705/health-expenditure-gdp-share-forecast-in-the-world

2 https://viewpoint.bnpparibas-am.com/thematic-investing-innovation-disruption-and-sustainability/

Legal warning

Some articles may contain technical language. For this reason, they may not be suitable for readers without professional investment experience. All opinions expressed in this document are those of the author at the date of publication, are based on available information and may be subject to change without prior notice. Individual management teams may have different opinions and make different investment decisions for different clients. This document does not constitute an investment recommendation. The value of investments and the income they generate could go down as well as up, and the investor may not recover his or her initial outlay. The returns obtained in the past are no guarantee of future returns. Investment in emerging markets or in specialized or restricted sectors is likely to be subject to higher than average volatility due to a high degree of concentration, greater uncertainty due to less information available, lower liquidity or greater sensitivity to changes in social, political, economic and market conditions. Some emerging markets offer less security than most international developed markets. For this reason, trade execution, settlement and conservation services on behalf of funds that invest in emerging markets could entail greater risk. Private assets are investment opportunities not available through listed markets such as equity stock exchanges. They allow investors to benefit directly from long-term investment themes and can provide them with access to specialized sectors such as infrastructure, real estate, private equity and other alternatives hardly available through traditional means. However, unlisted assets require close scrutiny as they tend to have high levels of minimum investment and can be complex and illiquid.