Miguel Luzárraga reviews this area of business in the United States and reveals its dependence on insurance companies and the importance of Medicare Advantage for it. Comment sponsored by AllianceBernstein.

GRANDSTAND of Miguel Luzarraga, country manager Iberia, AllianceBernstein. Comment sponsored by AllianceBernstein.

Because the insurance companies in the United States Are they key to the behavior of the sector? They assume an important private sector component of the US healthcare systemand have been under great pressure due to disappointing reimbursement rates from government-supported programs and upward utilization trends.

In the American healthcare system, insurance groups are companies that provide integrated care to patients and health insurance to their members. They provide a network of doctors and service providers, such as general practitioners, physiotherapists and specialists. This approach is widespread in the United States, not least because the country lacks a centralized public system.

Health sector stocks started 2024 with little enthusiasm. In the first four months of the year, the advance of the MSCI World Health Care Index was just 3.2% in dollars, below the 4.8% registered by the MSCI World Index. Maybe Defensive characteristics of the healthcare sector simply may not be what equity investors need at a time of less concern about macroeconomic growth, but we do not believe that is the case.

In our opinion, healthcare stocks offer a powerful combination of defensive and growth characteristics that are able to capture much of the market’s advance, while reducing downside risk. A diversified approach is required to achieve better long-term relative returns in bull and bear markets. regarding the sector. This approach must look beyond those large pharmaceutical groups that often grab the headlines with new treatments and best-selling drugs.

Understand the US insurance industry

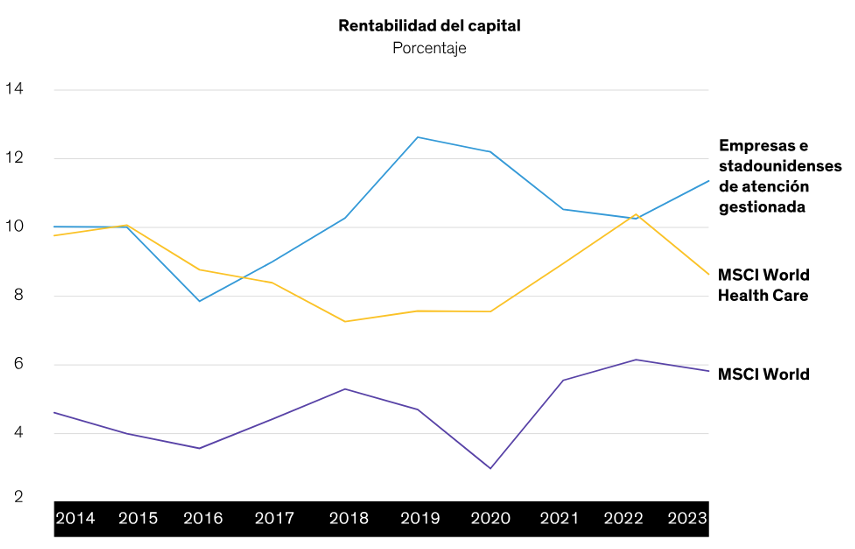

American insurance companies provide large health care services (including health insurance) to their members through a network of providers, and offer a variety of health plans. There is a selection of companies that generally have stable and recurring sources of income.in addition to having attractive growth rates and profitability, measured by return on capital.

Managed Care Companies Have Posted Strong Profitability

However, insurance stocks have been hit this year by two main issues. First of all, medical costs have increased due to normalization trends following COVID-19, as many older members request to undergo scheduled surgeries that were postponed during the pandemic.

On the other hand, in early April, the sector suffered a setback following the annual update of Medicare Advantage (MA) reimbursement rates. MA is a health insurance plan for senior citizens and people with certain disabilities offered by insurers that receive funds from the government for administering the plans. Each company must take into account the expected costs and reimbursement rates to generate a profit. In mid-2023, insurers began to see higher-than-expected MA utilization trends, resulting in higher costs. Stocks across the sector therefore suffered declines when a lower 2025 MA redemption rate was announced than forecast the previous month.

Diversified companies can deal better with the situation

Although the concern is legitimate, investors should not draw general conclusions from recent events. In this regard we believe that MA reimbursement rates will affect insurers in different ways. Investors who know the sector well know that the government updates these rates every year, so lower than expected rates are a known risk factor in companies’ profit forecasts.

Less diversified companies that rely more on MA have greater exposure to unfavorable rate changes and high MA utilization trends. That’s why, Humana company that provides comprehensive health and wellness services whose business largely depends on MA plans, lowered its profit forecasts at the beginning of the year, causing its shares to plummet. CVS Health, another Medicare Advantage major, also lowered its May profit forecast due to pressure from higher cost trends.

Insurers with a strong performance track record are better positioned to address the situation. They are between them UnitedHealth Group and Elevance Healththat have relatively moderate exposure to MA plans, plus many capabilities to boost your other businesses and help offset unfavorable MA rates and usage trends. These companies also have a track record of disciplined pricing and strong MA margins, which should help them protect their profitability without substantially cutting benefits.

Promote the virtuous ecosystem of the health sector

When investing in the health sector, we believe that it is essential to know how to distinguish those companies that operate within what we call a virtuous ecosystem. We refer to companies that offer a product or service that benefits the patient and that helps reduce costs for the patient and the system while generating a benefit.

The ability of diversified insurers to adapt to lower rates is enhanced by their critical role in the functioning of a virtuous healthcare ecosystem. In United States, A number of insurance companies have launched initiatives to vertically integrate their businesses, among them, the construction of a huge network of doctors and health professionals. This has made it possible to offer benefits to members that contribute to better access to care and higher quality of care, all while reducing costs for the health system. These measures have provided business advantages that help these companies gain market share while generating strong profitability and growth.

We believe that companies that operate in this virtuous circle offer equity investors a very interesting opportunity to capture long-term profitability potential in different segments of the healthcare sector.

A risk-aware approach to further growth

Of course, prudent investors should evaluate the risks, including changes in tariffs, increased utilization of services and the US elections. However, we believe that The short-term volatility related to these issues does not negate the long-term attractiveness of the sector.. For example, our analysis indicates that healthcare stocks are not more volatile in US election years, despite the long-held view that the sector is vulnerable to political and regulatory risk.

As in any other sector, some insurance companies have better vital signs than others, giving them greater scope to deal with the changing dynamics of the sector. We believe that by focusing on companies with competitive advantages that allow them to maintain profitability in times of market conflict, Healthcare investors will find insurance stocks offer an interesting mix of features to drive the portfolio’s long-term growth potential.